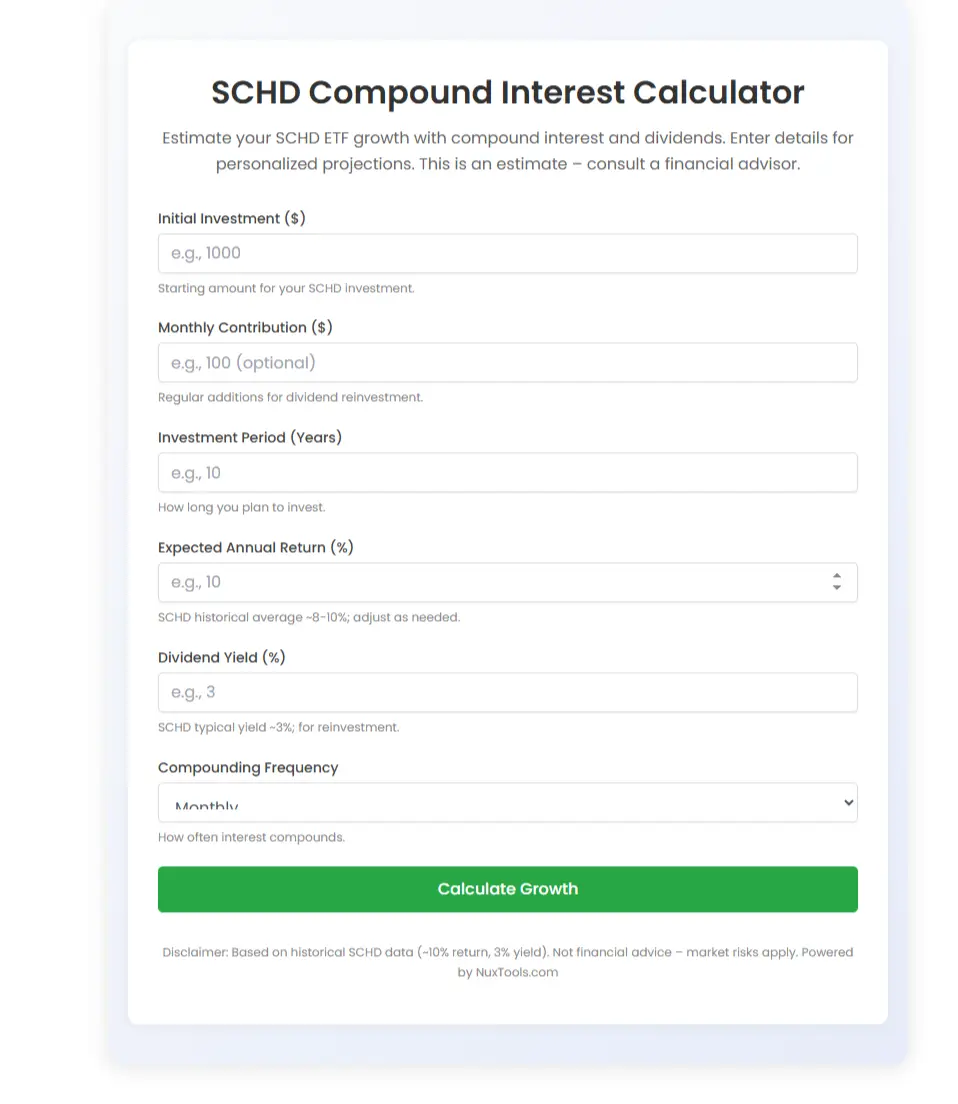

SCHD Compound Interest Calculator

Estimate your SCHD ETF growth with compound interest and dividends. Enter details for personalized projections. This is an estimate – consult a financial advisor.

Dreaming of growing your SCHD ETF holdings through smart compounding? Our SCHD Compound Interest Calculator makes it easy – just plug in your numbers and get realistic projections! As a free SCHD calculator online, it factors in dividends and expected returns, giving investors like you a reliable estimation tool for retirement planning or passive income strategies. Whether you’re new to SCHD or a seasoned holder, this calculator demystifies investment growth by showing the effects of compounding and dividend reinvestment. With user-friendly inputs and detailed outputs, you can forecast how your initial investment and monthly contributions could blossom over time. Let’s explore how this tool can power your financial journey with clarity and confidence.

What is SCHD Compound Interest Calculator?

The SCHD Compound Interest Calculator is a specialized online tool designed to estimate the growth of your investments in the Schwab U.S. Dividend Equity ETF (SCHD) by accounting for both compound interest and dividend reinvestments. Unlike basic compound interest calculators that often ignore dividends or assume a fixed interest rate, this tool introduces key SCHD-specific parameters such as dividend yield and compounding frequency, giving you an accurate and realistic picture of your portfolio’s potential growth over time. By combining your initial investment, regular monthly contributions, expected annual return, and dividend yield, the tool simulates how your balance can grow year after year, illustrating the power of compounding in dividend ETFs.

Using this SCHD ETF growth calculator helps investors visualize portfolio accumulation driven by both price appreciation and dividend reinvestment—a factor critical to long-term wealth generation. Whether planning for retirement or passive income, this calculator guides you in making smarter, data-driven decisions tailored to the unique characteristics of SCHD.

Why Focus on SCHD ETF?

SCHD, or Schwab U.S. Dividend Equity ETF, is a popular exchange-traded fund that targets high-quality, high-dividend U.S. stocks. It boasts a historical average annual return close to 10% and a typical dividend yield around 3.5%, making it an attractive choice for investors seeking consistent income and growth. Due to the steady dividend payouts and reinvestments, compounding plays a significant role in wealth accumulation with SCHD.

Over long investment horizons, even modest dividends reinvested consistently can dramatically accelerate portfolio growth thanks to the snowball effect of compounding returns. This makes SCHD an ideal candidate for investors who seek balance between income and capital appreciation, and why understanding its compound growth potential is essential.

How This Tool Differs from Basic Calculators

Most compound interest calculators simply use a fixed interest rate and principal balance, ignoring multiple real-world factors. In contrast, the SCHD Compound Interest Calculator incorporates dividend yields, regular monthly contributions, and realistic reinvestment schedules. This approach offers a breakdown of gains from dividends separately, reflecting how SCHD’s stable dividend payouts enhance portfolio growth.

Additionally, the tool allows selection of compounding frequency (monthly, quarterly, annually), which greatly affects outcome accuracy—something not offered by simpler calculators. By tailoring calculations specifically for SCHD’s historic performance and dividend characteristics, this calculator delivers actionable insights to investors aiming to optimize their investment strategy with precision.

For those curious to learn more about SCHD, visit the official Schwab SCHD ETF page, a great resource for fund details and historical data.

How Does the SCHD Compound Interest Calculator Work?

Curious about the math? It’s simpler than you think – here’s the breakdown! The SCHD Compound Interest Calculator uses a tailored formula that combines your initial investment, regular contributions, expected returns, and dividend reinvestments to project how your SCHD ETF holdings grow over time. By simulating interest compounding with realistic SCHD dividend yields factored in, the tool gives you a personalized estimate of your future portfolio value, helping you plan smarter.

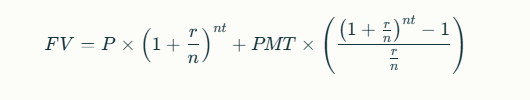

The Compound Interest Formula Explained

At its core, the calculator leverages this classic formula, adjusted for SCHD’s dividend payouts:

Where:

- FVFV = future value of the investment

- PP = principal or initial investment

- rr = annual interest rate (expressed as a decimal)

- nn = number of compounding periods per year

- tt = number of years invested

- PMTPMT = regular contribution each period

For example, if you start with $1000, expecting a 10% annual return compounded monthly and contribute $100 monthly, the formula estimates how your investment grows factoring compound interest and contributions. This gives you a more realistic view than simple interest calculations.

Incorporating Dividend Reinvestment

Dividends are like extra earnings added annually or monthly, significantly boosting your growth. The calculator includes SCHD’s typical dividend yield — around 3% historically — and reinvests those dividends back into your investment. This “snowball effect” increases your principal, which in turn earns more interest. Using updated SCHD dividend data ensures projections reflect real-world scenarios. Reinvested dividends often make a huge difference in long-term returns compared to just collecting them as cash.

Handling Variables Like Returns and Frequency

The tool starts with a default 10% expected return, reflecting SCHD’s historical average. But returns can fluctuate, so you can adjust this based on your outlook.

Compounding frequency significantly impacts growth:

- Annually: Simplest, least frequent compounding

- Quarterly: More frequent, better growth accuracy

- Monthly: Reflects most real-world scenarios, highest growth potential

Each has pros and cons:

- Annually might underestimate future value

- Monthly offers best precision but requires more complexity

- Quarterly finds balance between the two

Adjusting these helps tailor the tool to your investing habits and SCHD’s payout schedule.

Key Features of Our SCHD Compound Interest Calculator

This SCHD Compound Interest Calculator stands out with its combination of powerful features to give you the clearest investment picture possible. Designed for both beginners and seasoned investors, it makes complex financial math easy and engaging.

User-Friendly Inputs

- Simple fields to enter your principal, monthly contributions, investment duration, expected returns, dividend yield, and compounding frequency

- Clear labels and helpful placeholder text avoid jargon or confusion

- All fields validated for easy and error-free use

Visual Growth Charts

- Interactive line graphs visualize your portfolio growth year by year

- Colorful, smooth animations bring your data to life

- Helps you see how compounding and dividends build wealth over time

Detailed Breakdown Table

- Yearly display of starting balance, contributions, interest earned, dividends, and ending balance

- Enables tracking of how each factor impacts your investment yearly

- Users gain transparency and deeper understanding of compounding effects

Additional Perks

- Free to use and mobile-responsive for access anywhere

- Saves input data during session for convenience

- SEO-optimized with keywords like “calculate SCHD returns” to help investors find this tool easily

- Clear disclaimer supports responsible investing and sets expectations

For more on SCHD ETF and dividends, visit Schwab SCHD ETF official page.

Benefits of Using a SCHD Compound Interest Calculator

Who doesn’t want to see their money grow? This tool makes planning exciting! Whether you’re just starting with investing or are mapping out your retirement, the SCHD Compound Interest Calculator provides a clear, realistic way to visualize your portfolio’s potential. With easy inputs and detailed outputs, it helps you remove guesswork and boosts confidence by showing exactly how your SCHD ETF investment could grow with consistent dividends and compounding returns.

For Beginner Investors

For beginners, visualizing returns can be intimidating — this calculator breaks it down into simple numbers, making the complex world of investing accessible. By inputting your initial investment and monthly contributions, you get to see how much your SCHD ETF holding could be worth over time. This reduces uncertainty and jumpstarts your investing journey with confidence. The easy-to-use interface means no jargon, just straightforward, reliable projections based on SCHD’s historic performance. It’s like having a financial tutor in your browser.

For Long-Term Planners

If you’re planning for retirement or long-term wealth building, this tool becomes invaluable. It acts as an effective SCHD long-term growth estimator, helping you forecast dividend reinvestment impact and compounding over decades. This lets you set realistic savings goals and keep track of your progress by tweaking variables like expected returns or contribution amounts. It encourages disciplined investing by clearly showing the powerful effect of time and compound growth on your SCHD portfolio’s value.

Overall Advantages

- Saves hours of manual calculations with fast, accurate simulations

- Provides educational insights, helping users understand compounding and dividends

- Motivates consistent investing by showing visible results over time

How to Use the SCHD Compound Interest Calculator: Step-by-Step Guide

Using the SCHD Compound Interest Calculator is easier than you think. Follow these simple steps to unlock the power of compounding and dividend reinvestment for your SCHD investments.

Step 1: Input Your Initial Investment

Start by entering the amount you’re beginning with – your principal. For example, $5000 is a realistic investment for many retail investors. Think of this as the foundation of your portfolio. Accurate starting amounts lead to meaningful projections. Remember, you can always adjust this whenever you add more funds or when you want to see how different amounts might grow over time.

Step 2: Add Monthly Contributions and Period

Next, include any monthly contributions you plan to make. Regular contributions, especially when combined with dividend reinvestment, significantly boost growth. This step reflects your commitment to growing your SCHD holdings steadily. Choose your investment period wisely – longer horizons allow compounding to work its magic fully, illustrating the exponential power over years or decades.

Step 3: Adjust Returns, Yield, and Frequency

The calculator starts you off with SCHD’s historical averages—a 10% expected return and around a 3% dividend yield—but you can customize these. Use current market research or personal goals to adjust if you expect higher growth or more conservative returns. Selecting your compounding frequency (monthly, quarterly, annually) impacts how often returns get reinvested, affecting your eventual gains.

Troubleshooting Tips

- Make sure all numbers are positive and within reasonable ranges

- If the calculator seems slow, refreshing your browser often helps

- Have questions? Consult the FAQ section or contact support for help

Frequently Asked Questions (FAQs)

How accurate is this SCHD compound interest calculator?

This calculator uses historical SCHD data with its focus on dividend-paying ETFs featuring low expense ratios (around 0.06%). It incorporates both dividend yields and compound growth, making projections realistic and tailored to SCHD’s unique characteristics. Accuracy depends on the quality of inputs and market variability.

Can I use this for other dividend ETFs like VYM or DGRO?

Yes! The calculator is flexible — just adjust the expected return and dividend yield inputs according to the ETF’s historical performance, and it will estimate growth for those funds as well.

Does this account for taxes or fees?

No, this model keeps things simple by excluding taxes and fees. It’s best to add a buffer manually in your planning to reflect real-world costs and tax implications.

How often should I update my inputs?

Ideally, update your inputs annually or whenever your financial goals or market outlook changes to keep your projections relevant.

Is monthly compounding realistic for SCHD?

SCHD pays quarterly dividends, but the calculator models monthly compounding to provide smoother and more precise growth estimates, helping users visualize progress more easily.

Can I export or save my results?

Not yet, but you can always take screenshots. PDF export and other options are being developed for future updates.

What is the Default Return Rate for SCHD?

The calculator uses a default annual return rate of approximately 10%, based on SCHD’s historical performance. This rate is fully adjustable so you can tailor it to conservative or optimistic scenarios.

Conclusion

Ready to project your SCHD growth? Dive in now and watch your investments soar with the power of compounding and dividend reinvestment. This SCHD Compound Interest Calculator empowers you to make informed decisions by showing clear projections personalized just for you. What’s your projected return? Share your experience or questions below to help build a community of savvy SCHD investors!